puerto rico tax incentives act 22

Congressional approval which is doubtful in this Republican Congress. Between 2015 mid 2019 these grantees generated 703 mm in local consumption activity.

Guide To Income Tax In Puerto Rico

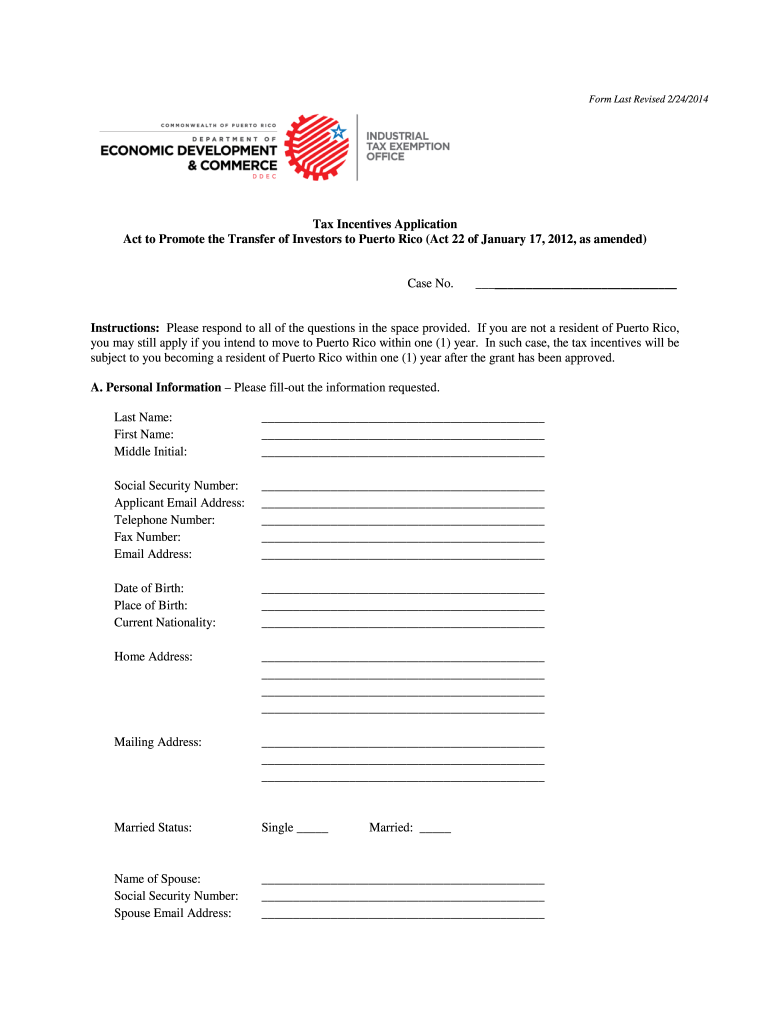

Act 22 Individual Investors Act.

. Act 20 and 22 tax incentives have been replaced by Act 60 as of January 1 2020. The law came into effect on January 1 2020 and altered previous legislation. 22 of 2012 as amended known as the Individual Investors Act the Act.

Per the recently published Tax Expenditures Report the fiscal cost of Act 22 is estimated at 29 mm for a single year. On June 11 2017 Puerto Ricans voted to change their status from US. Purpose of Puerto Rico Incentives Code Act 60.

Michelle Kantrow-Vázquez December 16 2021. The Act provides tax exemptions to eligible individuals residing in Puerto Rico. If youre a non-resident in Puerto Rico and.

Act 22 is now part of Act 60 Chapter 2 Incentives for Individual Investors. Under Act 22 bona fide residents of Puerto Rico who qualify can completely eliminate capital gains tax with a 100 tax exemption on assets acquired after the applicant has qualified. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business.

With the tax incentives overhaul of 2019 a couple of new requirements were added to Act 22 beginning in January of 2020. Johnston is free on bail and cannot travel to Puerto Rico. Territory to statehood in a non-binding referendum.

Citizens that become residents of Puerto Rico. Changes to Act 2022 New Incentives Code of Puerto Rico for Jan 1 2020. In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1.

PRs Acts 20 22 add 36K jobs inject 12B from 12 to 19. Act 22 seeks to attract new residents to Puerto Rico by providing a total exemption from Puerto Rico income taxes on all interest and dividends realized after the individual becomes a bona fide resident of Puerto Rico. US investors could be required to pay as much as 20 in federal taxes on dividends and capital gains.

On January 17 2012 Puerto Rico enacted Act No. On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. This is the time to invest in puerto rico.

And services are rising and purchasing power is declining. It systematizes dozens of incentive acts Acts 20 and 22 are just the most famous ones that Puerto Rico has enacted over the years. Puerto Rico Tax Incentives Act 60.

Along with the long-standing bona fide residence requirement the Puerto Rico housing incentive act now requires you to now buy a home and make a qualifying donation to a local Puerto Rican charity. Act 22 grantees pay property income and sales and use taxes in Puerto Rico among other state revenues. Statehood would render PRs territorial tax incentives invalid including Act 22 and 20 for traders and investment managers.

This Code is approved with the conviction that it shall improve Puerto Ricos economic competitiveness. Act 20 aka the Export Services Act specifically provides. Chapter 2 Individuals Previously known as Act 22 Annual charitable donation.

Under the new law grantees will need to make a 10000 annual charitable donation 5000 of that donation will go to a government-approved list of charities and 5000 may go to any Puerto Rican charity of your choice. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investors. Govt revokes 121 tax incentives decrees under Act 22.

Of particular interest are Chapter 2 of Act 60 for Resident Individual Investors and Chapter 3 for Export Services which shield new residents who live in Puerto Rico for at least half the year from paying most federal income taxes. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS Contact. Act 22 is now part of Act 60 Chapter 2 Incentives for Individual Investors.

In a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business. This explicitly includes capital gains earned. On January 17 2012 Puerto Rico enacted Act No.

Puerto Rico Tax Incentives Act 2022 Doing Business in Puerto Rico Moving to Puerto Rico. The application for an Act 20 Decree must include the payment of a 750 filing fee. Clair another Act 22 grantee announced more than 200 million in investments for the Island.

The government of Puerto Rico enacted in 2012 Act 22 known as An Act to Promote the Relocation of Individual Investors to prime up the economic development of Puerto Rico by offering non-resident individuals 100 tax exemption on all interest all dividends and all long-term capital gains. The Act may have profound implications for the continued economic recovery of Puerto Rico. Make Puerto Rico Your New Home.

The Impacts Of Puerto Rico S Act 20 And Act 22

Puerto Rico Tax Incentives Act 20 Act 22

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business

New Puerto Rico Act 20 22 Tax Incentive Calculator For Businesses And Investors

Relocate Puerto Rico Puerto Rico Tax Incentives Act 20 Act 22 Residency Facebook By Relocate Puerto Rico

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

Act 22 Individual Investors Puerto Rico Tax Incentives

Act 22 Individual Investors Puerto Rico Tax Incentives

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Centro De Periodismo Investigativo Puerto Rico Act 22 Tax Incentive Fails Centro De Periodismo Investigativo

Puerto Rico Application Act 22 Fill Online Printable Fillable Blank Pdffiller

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union